About the Workshops

Knowledge enables more powerful choices

Who says learning can’t be fun?!

Let’s face it – Most people learned about money through the school of hard knocks or playing Monopoly. And Monopoly only teaches about real estate.

Financial Choices are not Made in Isolation.

In these workshops we put the topics together to explore how savings can protect you against emergencies, how debt can reduce your choices, how choosing to spend on expenses that provide little value can instead be put into savings and investments, and how that can increase your worth.

We don’t just talk…

Rounds of the game are played in each of the eight workshop sessions, and distinctions are drawn from the experiences.

Why Experience-Based Learning Matters

If you learned how to ride a bicycle by reading a book, how long would it take?

The truth is to really learn how to ride a bicycle, you have to ride a bicycle. No matter how much you study, how much you talk about it, how many times you watch someone riding, you still won’t truly know how until you experience it yourself. The same is true with finances.

As They say “Practice makes perfect.” As We say “Make your financial mistakes here where it won’t cost you.”

That’s why MentaMorph Money is so valuable.

You can practice making financial decisions over and over, testing different strategies in the same and different scenarios. The workshop content enhances and anchors the lessons.

The game experience combined with the educational content provides tools to relieve, avoid and eliminate financial pain.

What the Workshops Cover

held to ensure a deep understanding of the concepts.

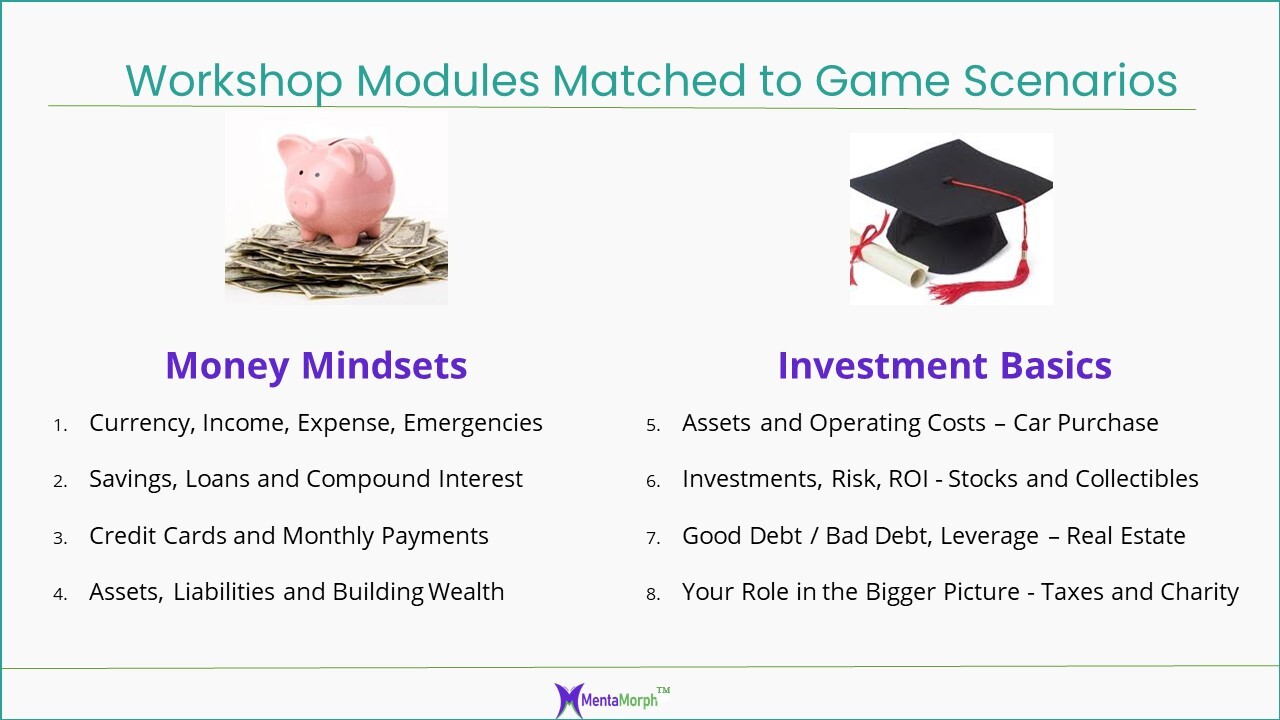

MentaMorph Money Mindsets

Four 1-1/2 to 2 hour sessions address fundamental financial concepts and about developing discretionary funds and get out of paycheck-to-paycheck mode.

MentaMorph Investment Basics

Four 1-1/2 to 2 hour sessions covering investments and their financial profiles – how to use discretionary funds for maximum benefit.

Social/Emotional Learning Too

Recent events show the need for life skills to be taught in schools in addition to scholastic studies. What if they could be taught at the same time?

Money is a form of energy storage or value storage, and teaching about money in a concept and game-driven way also provides the opportunity to relate it to human energy.

For instance, non-monetary currency includes our time and energy. Assets including knowledge skills and relationships.

By creating a curriculum and artifacts that teach the principles in a physical way, and by relating the principles to the students’ own personal lives, participants gain a clearer and deeper understanding of the concepts while learning about life.

Cart is empty

Cart is empty